What are commission clawbacks in Sales?

- Amit Jain

- Jan 10, 2025

- 4 min read

- Last updated on Feb 04, 2025

What are clawbacks?

- Clawbacks refer to any money or benefits that have been distributed but must be returned (clawed back) due to certain circumstances or events. For example, monies received where a clawback provision exists in the executive compensation contract due to customer cancellation or a drop in performance.

- The clawback occurs when the employee pays back some or all of the sales commissions earned.

- In sales, a clawback can occur when a company pays a rep commission on a sale, and the customer abruptly terminates the contract within a certain time frame.

- Clawbacks are most commonly used when companies want to protect revenue while incentivizing their salespeople to land accounts that they believe will grow over time.

Typical clawback provisions

A clawback provision requires a sales representative to return the commission to their employer if the sale is not fulfilled (for example, a client never pays an invoice) or the customer churns within a certain time frame. Sometimes, clawbacks are used to compensate for deals with lower-than-expected margins for example when the customer downgrades the offering that was originally purchased.

Why do companies use commission clawback?

Clawbacks safeguard the company.

Salespeople are compensated based on the revenue they help generate. If that revenue is not generated, the company will lose money. Clawbacks protect the company from overpaying its sales team for poor sales practices or unanticipated changes in circumstances.

Employers cannot withhold wage payments that include sales commissions. However, employers can make exceptions to this rule in the commission agreement, which serves as the employee contract.

Motivate sales reps to retain customers.

Why are clawbacks used for sales teams? The company may suffer financial losses if the targeted revenue is not generated. Clawbacks protect the company from overpaying your sales team due to poor sales practices or unforeseen changes in circumstances.

Clawbacks are important for motivating sales representatives to follow through with customers, preventing contracts from being terminated prematurely, and focusing on contract renewals to improve retention rates. Clawbacks motivate sales representatives to follow through with customers, prevent contracts from being terminated prematurely, and focus on contract renewals to improve retention rates.

Last resort

Most businesses avoid clawbacks unless necessary and only use them in specific situations, such as when sales contracts expire prematurely, or deal margins fall below target.

Companies will sometimes pay commissions in advance of a deal closing or when a contract is signed. These revenues only sometimes materialize, forcing businesses to use clawbacks to recover the corresponding commission

Pitfalls of using clawbacks

Demotivates your employees

When dealing with clawbacks, transparency is essential. You must ensure that your clawback policies follow state and federal laws. The wording and phrasing you use when including a clawback clause in your employment contract are critical.

The contract should be legally enforceable and should leave no room for interpretation. Suppose your employees feel taken advantage of as a result of inappropriate clawbacks. In that case, it can lead to serious demotivation on your team. Worse, it can lead to lawsuits that harm your credibility and brand.

Accounting Burden

Commission clawbacks can be an accounting disaster, especially for public companies that must file ASC 606 and public earnings statements. Large clawbacks may necessitate an earnings restatement, making it difficult to gain useful insights from long-term forecasts.

Continue to block visibility.

Even the most straightforward clawbacks introduce an element of complexity that salespeople will naturally try to account for during the sales process. Too many clawback scenarios risk confusing and demoralizing your representatives and increasing the number of sales commission disputes,

Example Scenario

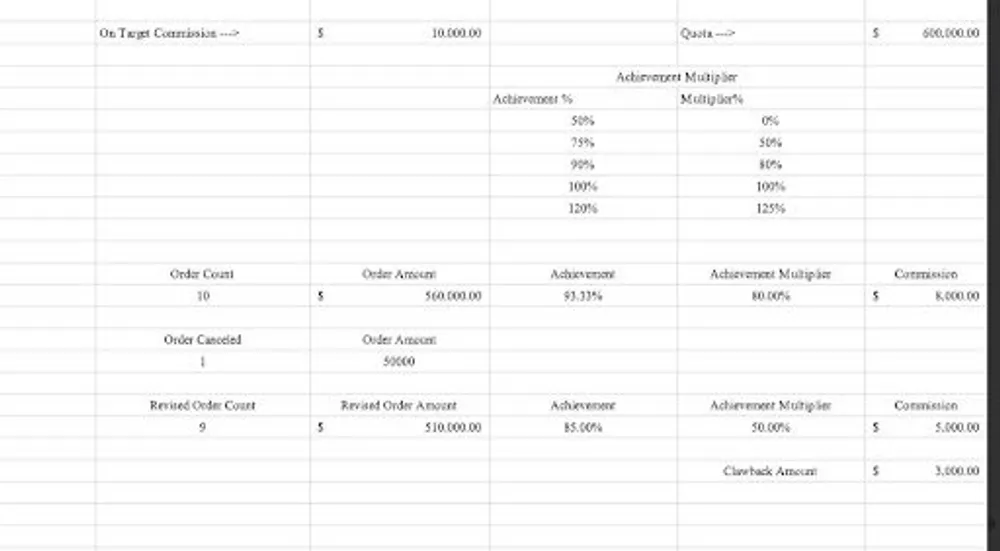

(Image - achievement multiplier table)

Let's break down Tanya's commission situation. Tanya had a yearly target of $600,000 with an on-target commission of $10,000. She had varying achievement multipliers to achieve her quota. (refer to the above image)

(Image - showing her commission clawback)

Tanya sold $560,000 worth of laptops annually, reaching 93% of her target. And with an 80% achievement multiplier, her commission was $8,000.

However, one of her orders was canceled, reducing her total sales to $510,000. This means she achieved 85% of her quota compared to her earlier 93% achievement. With a reduced achievement multiplier of 50%, her commission dropped to $5,000. So, she owed $3,000 to her organization (commission clawback) due to the canceled order, compared to her original commission of $8,000.

Conclusion

Clawbacks aren’t limited to sales commissions. They also apply to bonuses, incentive programs, and other forms of compensation. Businesses use commission clawbacks as a last resort when an employee fails to meet expectations. Employees who fail to make a sale will not receive any money until the company recovers its losses.