Why LMS Cannot Be Your Incentive System?

- Sumeet Shah

- Jun 30, 2025

- 4 min read

- Last updated on Sep 29, 2025

Introduction

In recent years, a growing number of Loan Management System (LMS) providers have started bundling incentive modules with their core offerings. On the surface, this sounds convenient—one system to manage both loans and sales incentives. But here’s the catch: convenience doesn’t always equal effectiveness. Many businesses, especially those in NBFCs, banking, and fintech, are starting to confuse two distinct processes: loan management and performance management. While they might share some data, they’re built for completely different purposes. This blog aims to explain why LMS is not an effective incentive system and what businesses risk when they fail to draw that line.

What Is an LMS (Loan Management System)?

A Loan Management System (LMS) serves as the backbone for financial institutions that deal with loans. It handles the entire lifecycle of a loan—from the moment a customer applies, to when they repay the last EMI. It ensures that every step is accurate, timely, and compliant with regulatory norms.

Here’s what an LMS typically does:

Loan Origination: It starts with checking the borrower’s eligibility. The loan management system handles application forms, credit checks, and risk profiling.

KYC and Documentation: It automates the collection and verification of essential documents, such as ID proofs and income statements.

Repayment Scheduling: Once approved, it structures the repayment plan—how much, how often, and when the payments will be due.

Collection and Compliance: If payments are missed, the loan management system triggers reminders or collection processes. At the same time, it ensures everything stays compliant with government and financial body regulations.

The primary users of an LMS are teams such as Operations, Collections, Compliance, and Risk. Their goal is to ensure that loans are managed smoothly and that funds are received without regulatory complications. In short, an LMS is primarily concerned with tracking finances, managing risks, and ensuring compliance.

What Is an Incentive Management System?

On the other hand, an Incentive Management System focuses on something entirely different: people and performance. It’s a tool that helps businesses track the performance of their sales teams and rewards them accordingly.

Think of it this way: if LMS is about managing loans, the incentive system is about fueling growth by keeping salespeople motivated and aligned with business objectives.

Here’s what it typically includes:

Target Management: This feature enables businesses to establish individual or team sales targets tailored to specific roles, regions, or product lines.

Plan Modeling: You can design different types of incentive plans—whether it’s commissions, bonuses, accelerators, or SPIFFs (short-term performance incentives).

Crediting Logic: It ensures the right salesperson gets credit for the right sale. This is critical when multiple people are involved in closing a deal.

Payout Calculations: The incentive system automates the calculation of how much each person should be paid based on their performance and the rules set in the plan.

Dashboards and Reporting: Salespeople and their managers can track performance, earnings, and progress in real time.

The primary users of an incentive system are Sales Ops, HR, Finance, and Business Heads—essentially anyone responsible for ensuring that performance leads to rewards.

While LMS manages risk, an incentive management system manages motivation and momentum. It ensures that salespeople stay engaged, know what they’re working towards, and are paid fairly and on time.

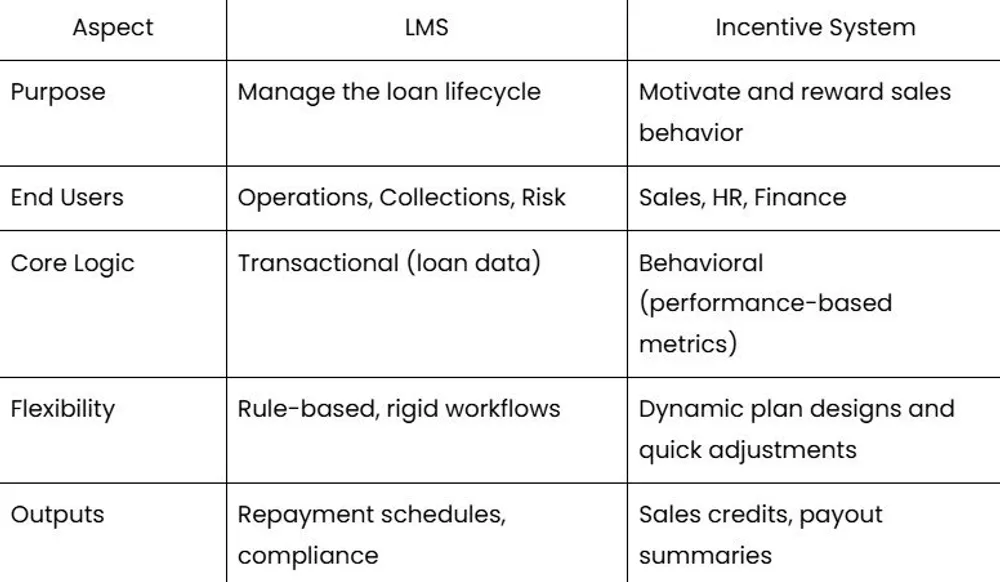

How Are LMS and Incentive Systems Fundamentally Different?

Let’s put it side-by-side:

Complexity of Using LMS for Incentive Automation

Here’s where the real issues begin. Trying to use an LMS to manage incentives leads to several complications, such as:

Standardized Logic: LMS workflows are designed for loan processing. They struggle to manage the complexity of sales incentives, such as SPIFFs, accelerators, or role-based goals.

Data silos: The LMS tracks loan data, not performance metrics such as cross-selling, upselling, new account openings, or call activities. That data lives in your CRM or other tools.

Hardcoded calculations: Making frequent changes to incentives (which happens a lot in dynamic markets) can mess with the stability of your LMS—something you don’t want to touch carelessly.

Poor audit capability: Incentive payout records are often hardwired into the LMS logic, making them difficult to trace or reconcile during audits.

Delays: Since incentive processing is often an afterthought, it typically occurs only after all loan data has been finalized and verified. Any change in the LMS system risks breaking the incentive logic—it’s like adjusting one formula in a spreadsheet and suddenly throwing off all the totals.

Business Risks and Implications

When incentives are managed within an LMS, it introduces structural limitations that accumulate over time, leading to operational delays, inflexible plans, and a general lack of trust in the process.

Demotivated Sales Teams

Salespeople thrive on clarity and timely rewards. When payouts are delayed, calculated incorrectly, or lack transparency, trust begins to erode. And when trust is lost, so is motivation. Over time, even top performers may lose interest, feeling that their efforts aren’t being recognized or rewarded fairly.

Compliance and Audit Risk

Incentive errors may seem small, but they can cause big issues during audits. If an auditor finds inconsistencies in payout data, it can lead them to question the reliability of your entire LMS, raising doubts about your core financial operations. For regulated industries, such as banking and NBFCs, this can be a serious red flag.

Plan Inflexibility

Markets change quickly. You might want to launch a new sales campaign, introduce a short-term SPIFF, or adjust targets mid-quarter. But with an LMS, making these changes is often slow, risky, or even impossible without disrupting other critical processes. What should take hours ends up taking weeks, or gets dropped altogether.

Operational Bottlenecks

Instead of focusing on their core job—managing loans—your LMS team ends up spending valuable time fixing incentive-related issues. That creates internal friction, delays, and confusion, especially when multiple teams are involved. The incentive system becomes clogged with use cases it was never meant to handle.

Scalability Issues

As your salesforce grows and diversifies, your incentive plans must also evolve. But LMS setups typically can’t support the complexity of multiple roles, varied KPIs, different territories, and layered incentive structures. What worked for a 20-person team quickly breaks down when you scale to 200.

Why Dedicated Incentive Systems Are the Smarter Choice

Instead of overloading your LMS with responsibilities it wasn’t built for, it’s time to consider a dedicated incentive system—a platform purposefully designed to manage sales performance, payouts, and motivation. Here’s why it’s the smarter, future-ready choice:

Built for change

A modern incentive system is designed to keep pace with the rapid evolution of your sales strategies. Whether you need to adjust quotas mid-cycle, introduce a new product bonus, or test different payout scenarios, these systems enable seamless adjustments without delays or disruptions.

Smart configurations for every role

Unlike rigid LMS setups, incentive systems allow you to define role-based logic for different sales personas—whether it’s field reps, inside sales, channel partners, or team leaders. Each role can have unique targets, payout rules, and performance metrics.

Integration and not duplication

A strong incentive system doesn’t try to replace your LMS or CRM—it connects with them. It pulls in relevant data (such as disbursements, product type, and customer details) and uses that information to calculate accurate and timely payouts without duplication of effort.

Audit-ready and transparent

When it comes to finances, transparency is non-negotiable. Incentive systems provide clean audit trails, traceable crediting logic, and clear reconciliation paths. So, whether it's internal reviews or external audits, you’re always prepared with confidence.

Performance-driven sales teams

Perhaps the biggest win? Trust. When your team understands how their incentives are calculated, can track them in real-time, and knows that payouts are accurate, they stay motivated. A transparent incentive system builds performance, boosts morale, and strengthens your culture of recognition and reward.

Conclusion

Loan Management Systems and Incentive Management Systems are both essential, but they are not interchangeable.

Trying to use your LMS for sales incentives might seem efficient in the short term, but it creates more problems than it solves. It complicates operations, limits flexibility, and frustrates your sales force. Over time, this mismatch leads to slower decision-making, disengaged employees, and missed revenue opportunities, which cost far more than any convenience it initially offered.

Incentive programs require adaptability, transparency, and speed—qualities that an LMS simply isn’t built to deliver. For businesses serious about growth, performance, and employee trust, separating these systems is not optional; it’s strategic.